irs tax levy calculator

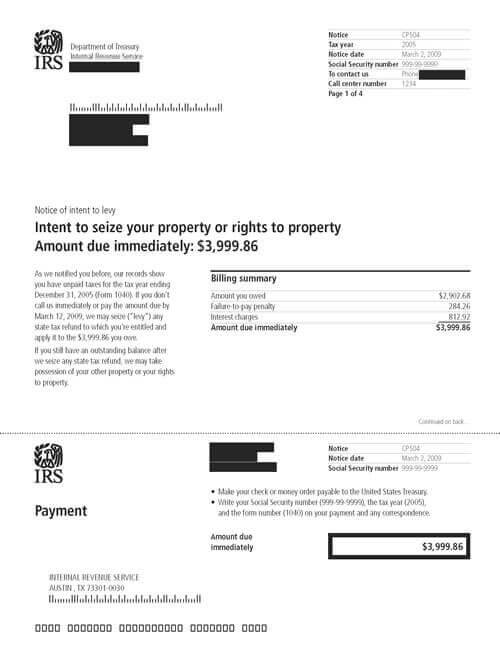

Help With an IRS Tax Levy. They remain in place until the IRS releases the levy or your debt is paid in full.

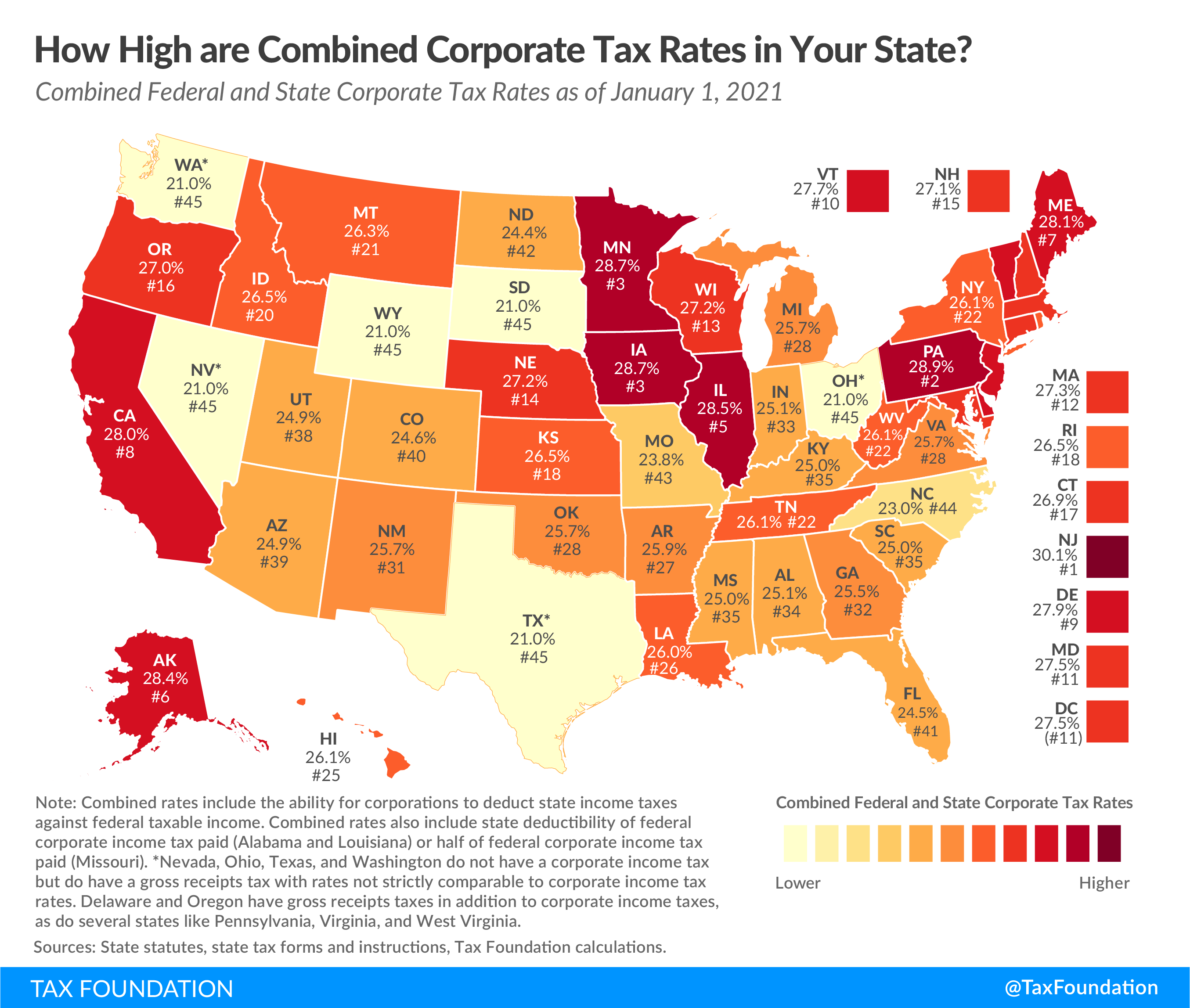

State Corporate Income Taxes Increase Tax Burden On Corporate Profits

Give it a Try.

. File your tax return on time. The IRS may also release a levy if the taxpayer makes other arrangements to. Use this tool to.

Dont Let the IRS Intimidate You. Employees gross earnings Dollars and cents for. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less.

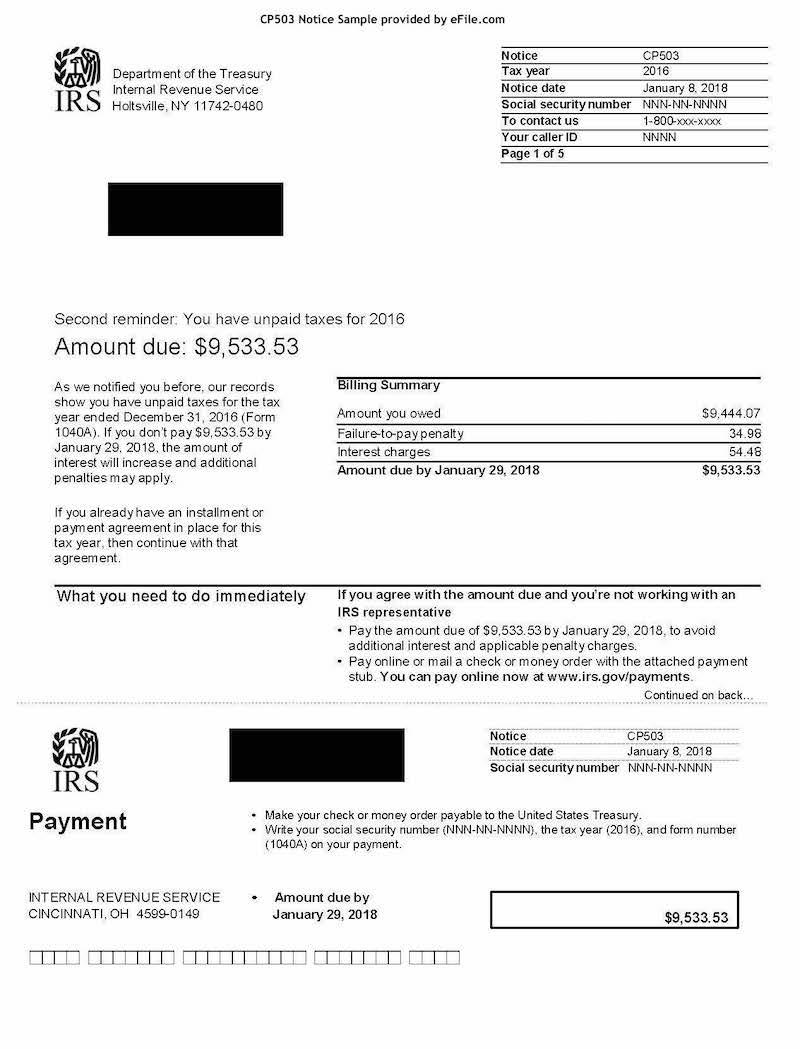

Ad Apply for tax levy help now. IRS tax penalty calculator is an online tool to compute the amount of penalty. A tax levy is a legal seizure on wages to satisfy a tax debt.

What is the IRS tax levy calculation. Estimate your federal income tax withholding. We are experienced tax attorneys in Houston Texas.

IRS tax forms. Get Free Competing Quotes From Tax Levy Experts. Ad pdfFiller allows users to Edit Sign Fill Share all type of documents online.

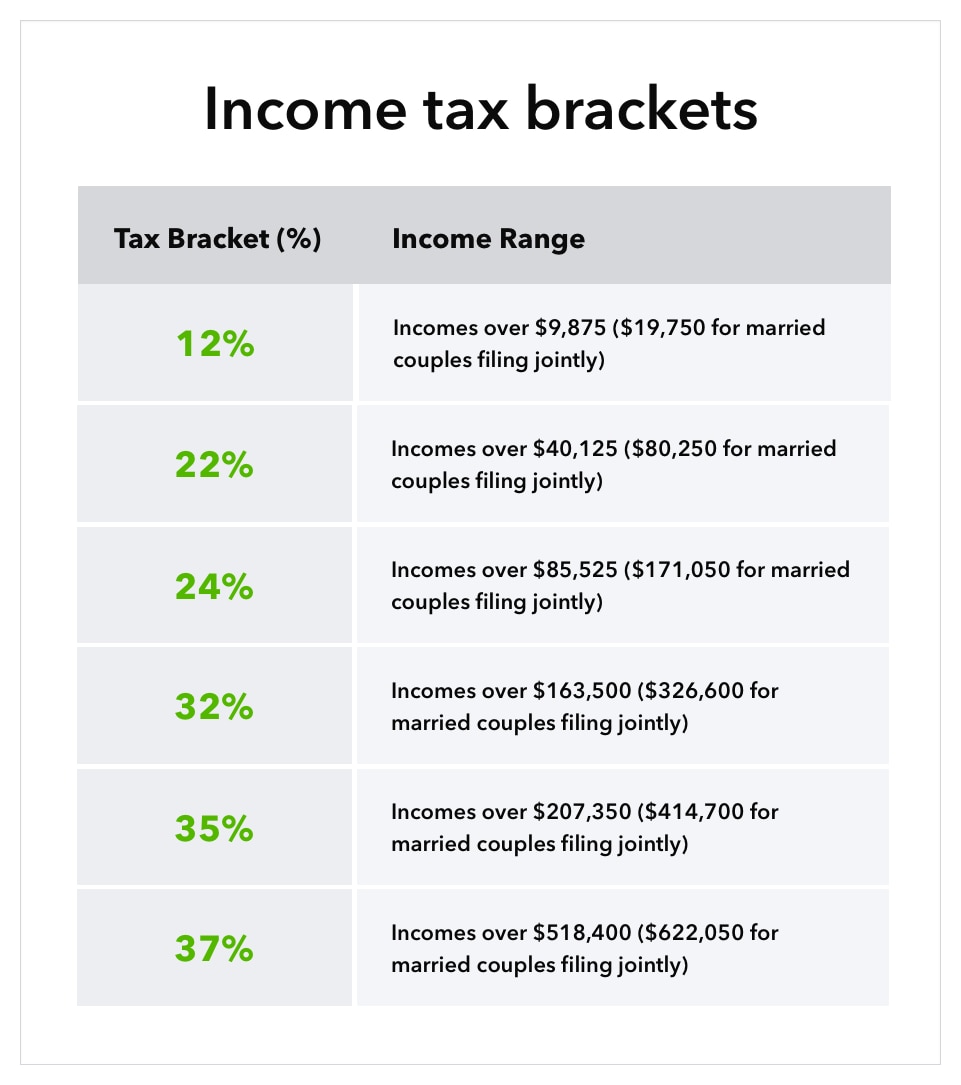

The amount of income tax your employer withholds from your regular pay. This calculator computes federal income taxes state income taxes social security taxes. The remainder is the.

Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations. Determine the disposable earnings. On Any Device OS.

Here is how we get compensated. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. The first withholding will come out.

Subtract the result in Step 3 from the result in Step 2. Total Deductions lines a-g above. Ad Browse Discover Thousands of Reference Book Titles for Less.

Calculate Social Security tax at 42 percent of gross income and Medicare tax at 145 percent. What is the IRS tax levy calculation. Get free competing quotes from leading IRS tax levy experts.

TaxInterest is the standard that helps you calculate the correct amounts. Recommends that taxpayers consult with a tax professional. An IRS levy permits the legal seizure of your property to satisfy a tax debt.

If you have a tax debt the irs can issue a levy. A single taxpayer who is paid weekly and claims three dependents has 50290 exempt from. If the IRS levies seizes your wages part of your wages will be sent to the IRS.

Wage garnishment occurs when the IRS.

7 Easy Steps For Tax Resolution Process Info You Need To Know

Irs Notice Federal Tax Lien Colonial Tax Consultants

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Resumes Tax Collection Programs Suspended Due To Covid 19 San Jose Tax Attorney

Who Do I Call About An Irs Tax Levy

Irs Penalty For Late Filing H R Block

How To Calculate Payroll Taxes Tips For Small Business Owners Article

Irs And State Bank Levy Information Larson Tax Relief

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

Understanding Irs Tax Levies And Garnishments

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Levy On Accounts Receivable Justice Tax Llc

Can The Irs Take Money From My Bank Account Manassas Law Group

What Is A Levy How To Get It Released Tax Debt Advisors

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Schedule C Audit Triggers What You Need To Know Tenenbaum Law P C

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

What Happens To Federal Income Tax Debt If The Person Who Owes It Dies